Proposition 22: A Wolf in Sheep’s Clothing

October 11, 2020

Earlier this year the California Labor commissioner filed suit against rideshare apps Uber and Lyft, claiming they willingly committed wage theft against their employees.

The companies responded saying their drivers would prefer to be treated as independent contractors. They cited public response as well as a survey, commissioned by Uber, claiming drivers rely on the flexibility the independent contractor classification affords to them.

The California Labor Department disagreed, providing numerous lawsuits and complaints against the ride share apps.

But the rideshare app companies fought back.

Together, with the help of delivery apps like Instacart and DoorDash, Uber and Lyft have raised nearly $200 million for Proposition 22, an attempt to exempt delivery and rideshare apps from the recently created Assembly Bill 5, which was passed in 2019 and went into effect Jan. 1.

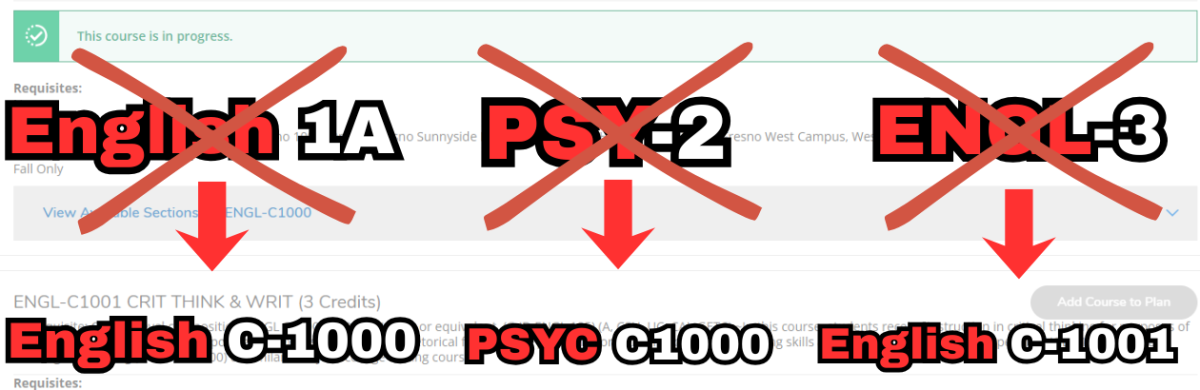

Assembly Bill 5 extended regulations in the classification of independent contractors. Under the new law, app-based delivery companies were required to provide drivers with the same rights and benefits awarded to company employees.

This includes minimum wage, overtime, unemployment insurance, and worker’s compensation.

On the surface, Proposition 22 claims to provide rideshare drivers with the freedom to work where they want and when they want, but at the heart of Proposition 22 is the tech industry’s desire to increase profit and self-regulate the tech economy.

But it wouldn’t be a multi-million-dollar tech company without clever marketing and cunning campaigning. In fact, they make worker exploitation trendy.

Architects of Proposition 22 claim that it’s the “third way” for gig workers, providing the best of both worlds.

Under Proposition 22, app-based delivery companies claim drivers would be paid 120% of the minimum wage for the duration of the driver’s engaged time.

Drivers working more than 25 hours a week would require companies to pay a stipend of 82% the average Covered California premium for each month, occupational accident insurance to cover at least $1 million in medical expenses and lost income in the case of injury suffered while driving, and accidental death insurance for driver’s spouse, children, or other dependents.

In a nutshell, the proposition would provide minimum earning, healthcare subsidies, and vehicle insurance to drivers all while allowing them to maintain the title of independent contractor.

Here’s the problem: app-based delivery companies are exploiting a working class reliant on second incomes and forcing them to bend to their every whim.

The well-being of the workforce is left to be determined and evaluated by the very company that profits off their work. But their interests don’t necessarily align.

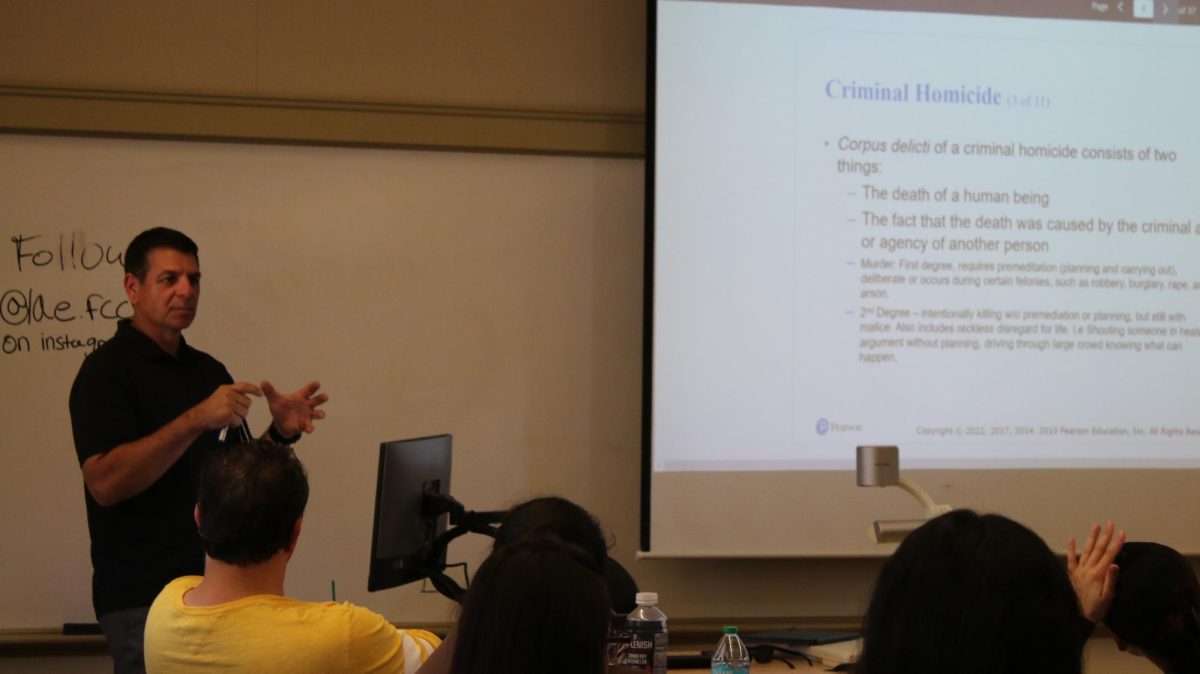

Fresno City College entrepreneurship instructor Amber Balakian agrees. “Uber and Lyft are publicly traded corporations, so they have a certain obligation to maximize shareholder value,” said Balakian. “This added cost would substantially impact their bottom line and negatively affect the stock price. They are obligated to do everything they can to see that does not occur.”

This added cost would be the millions of dollars it would take to provide drivers with the benefits required of app-based delivery companies under AB 5.

Instead, the companies are offering their own benefits, but their benefits don’t offer the same protection AB 5 does.

According to researchers at The UC Berkeley Labor Center, the 120% of minimum wage, when considering multiple loopholes in the proposition, would actually amount to only $5.64 per hour—far below California’s minimum wage.

But don’t these companies have the worker’s best interest at heart?

Yes, if companies are under the assumption their drivers would prefer to be classified as independent contractors.

The only issue is, drivers don’t meet all the requirements to be listed as independent contractors.

Gig workers or independent contractors typically don’t rely on one or two contracts for their business, they rely on multiple contracts.

Under the IRS definition, independent contractors have control over their work, how many hours they work, what they charge, and perform work outside of work regularly performed by the business they’re contracted by.

Companies like Uber and Lyft depend on the vagueness in the relationship with their drivers to purposely misclassify and cut labor cost.

Champion of labor rights, Dolores Huerta called proposition 22, “predatory business practices,” saying it targets a workforce that primarily consists of people of color. The passing of proposition 22 would, “roll back decades of hard-won progress on historic labor law protections for workers,” writes Huerta.

App-based delivery companies argue that the cost of classifying their drivers as company employees would force rates to go up, reduce the number of drivers, and reduce services offered in many cities, even threatening to move out of California for good.

By using driver’s jobs as their bargaining chip, app-based delivery companies have forced drivers to face the hard decision, accept how these companies chose to treat you, or risk losing your job.

Prop 22 is nothing more than a wolf in sheep’s clothing.